According to JPMorgan Survey: 72% of Institutional Investors Avoid Crypto

- Brandon Davis

- February 2, 2023

- Crypto, News

- 0 Comments

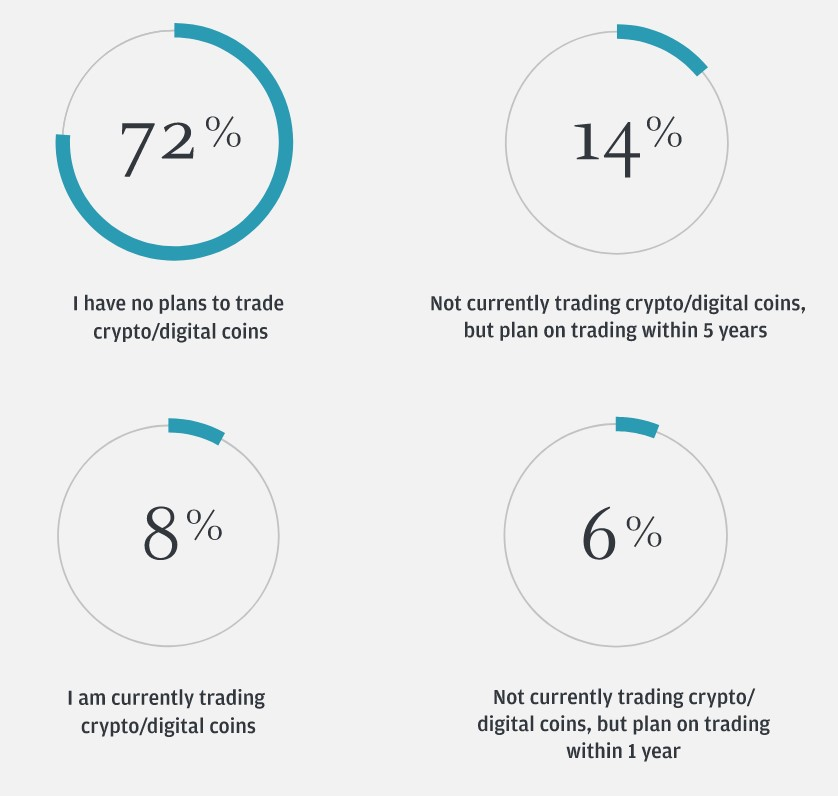

JPMorgan conducted a study which found that 72% of institutional investors have no plans to invest in cryptocurrencies in the year 2023. This is in contrast to a study conducted by financial advisory firm deVere, which found that 8 out of 10 millionaires show interest in cryptocurrency.

The study showed that a mere 14% of participants reported that they would trade cryptocurrencies in 2023, with an additional 14% indicating that they may trade within the next 5 years. The majority, 72%, stated that they do not plan to invest or trade in cryptocurrencies at any point in the future.

Reasons for Lack of Confidence in Cryptocurrency

This lack of confidence could be due to the current market volatility and recent events in the crypto industry, such as the FTX collapse. Additionally, the survey found that 90% of individuals had no exposure to digital assets at the time of the survey. The timing of the survey, conducted in early 2023 after the FTX collapse, may have also contributed to the negative results.

While it is clear that the majority of institutional investors are not ready to invest in cryptocurrency, it is important to note that the market is constantly evolving. The rapid pace of technological advancement means that new and innovative products are always being developed. In the near future, new and improved investment opportunities will likely arise in the cryptocurrency market, leading to a change in the investment behaviour of institutional investors.

Impact of Economic Factors

Recession, inflation and interest rates are three economic factors that impact the stock market and are closely monitored by investors. The survey showed that nearly a third of investors considered recession risk the most important factor. At the same time, a quarter was concerned about the impact of inflation and interest rates on their crypto trades.

***