Grayscale Gains Ground as SEC Accepts Court Ruling on Bitcoin ETF

- Rudolph Harmon

- October 14, 2023

- Crypto, News

- Bitcoin ETF, Grayscale, SEC

- 0 Comments

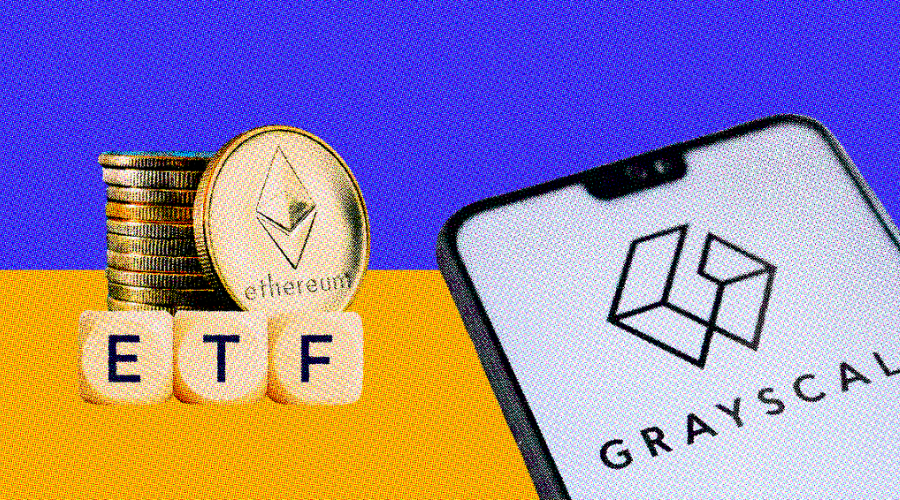

The SEC opts not to contest a court ruling favoring Grayscale’s Bitcoin ETF, potentially signaling a shift in cryptocurrency ETF regulation.

Key Takeaways

- The SEC will not contest the court ruling favoring Grayscale’s Bitcoin ETF application.

- In August, the District of Columbia Court of Appeals found the SEC’s rejection unjust.

- The SEC had previously denied all spot bitcoin ETF applications, including Grayscale’s.

- The decision may herald a change in the ETF landscape, with other applications pending.

In a decision anticipated with bated breath, the US Securities and Exchange Commission (SEC) has reportedly chosen not to challenge a pivotal court ruling in favor of Grayscale Investments related to its bitcoin exchange-traded fund (ETF) application.

The original ruling, made by the District of Columbia Court of Appeals in August, deemed the SEC’s rejection of Grayscale’s ETF as inappropriate, thereby ushering in an opportunity for the regulatory agency to reassess the application.

🚨 Breaking News 🚨

🇺🇸 SEC will not appeal court's decision on Grayscale's #Bitcoin ETF!

SP500 red this Friday. #BTC is green and above 27k!

Is this a sign? They will approve Spot BTC ETF soon? pic.twitter.com/bIpMrOtscG

— Seth (@seth_fin) October 13, 2023

SEC Resistance to Bitcoin ETF

Historically, the SEC has persistently resisted the approval of spot bitcoin ETF applications, invoking the rationale that applicants have failed to sufficiently demonstrate their capability to shield investors from potential market manipulation. Grayscale’s application was no exception to this trend, initially facing denial on these grounds. Nevertheless, the unfolding scenario may beckon a subtle shift in the regulatory environment governing bitcoin ETFs.

Interestingly, Grayscale isn’t navigating these regulatory waters alone. Several other asset managers are lingering in the application pipeline, their prospects arguably brightened by the recent developments in Grayscale’s journey. The SEC’s decision not to appeal against the court’s ruling could potentially lay down a fresh track for other pending applications, inciting a ripple effect through the asset management sphere.

Concluding Thoughts

The SEC’s decision to stand down from appealing against the Grayscale ruling not only marks a potentially pivotal moment for the investment firm but may also signify a softening stance towards cryptocurrency-related products in the broader financial ecosystem.

The potential review and eventual approval of Grayscale’s Bitcoin ETF could ignite a paradigm shift in how regulatory bodies perceive and engage with cryptocurrency investment vehicles, especially concerning investor protection against market manipulations and fraudulent activities.

However, while the immediate implications might stir optimism among crypto enthusiasts and investors, it’s pivotal to navigate this potentially evolving landscape with a blend of cautious optimism and critical evaluation.

The eventual outcomes of these regulatory maneuverings, especially concerning other lingering ETF applications, could vastly reshape the investment frontier, opening up new avenues while possibly ushering in fresh challenges in maintaining a secure and transparent crypto trading environment.