Marathon Digital CEO Predicts More Forced Exits Amidst Mounting Challenges in the Bitcoin Mining Sector

- Rudolph Harmon

- June 14, 2023

- Bitcoin, Crypto, News

- Bitcoin, CEO, Crypto, Marathon, Mining

- 0 Comments

Key Points

- Fred Thiel, CEO of Marathon Digital, predicts that challenges will drive some Bitcoin miners out of the market.

- Thiel’s prediction comes amidst mounting challenges in the Bitcoin mining sector.

- The recent crypto crash has also prompted regulators around the world to increase scrutiny on mining.

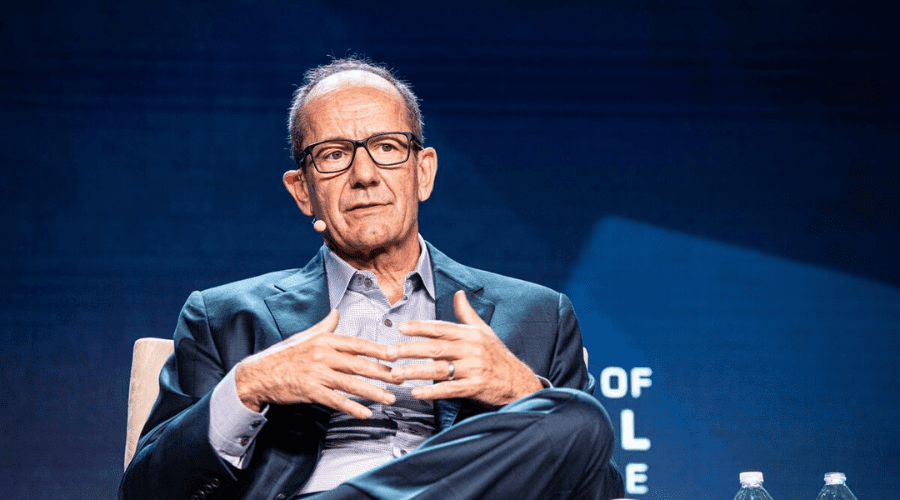

The CEO of Marathon Digital, Fred Thiel has sounded the alarm bells for Bitcoin miners, warning them of the mounting challenges that lie ahead. Thiel, a seasoned industry expert, believes that a range of factors including regulatory pressures, escalating energy costs, and the upcoming “halving” event, will make it increasingly difficult for miners to sustain their profitability.

The “halving” event, which will probably take place in 2024, will reduce the mining reward by half, posing a significant challenge for miners to continue their operations. As the industry braces itself for these challenges, it remains to be seen how many miners will be able to weather the storm and emerge unscathed.

⚠️ JUST IN: The CEO of Marathon Digital $MARA anticipates additional deals involving #Bitcoin miners – Bloomberg

— BecauseBitcoin.com (@BecauseBitcoin) June 13, 2023

Bitcoin Miners Feeling the Heat

As Bitcoin continues to make headlines, it is also facing increased scrutiny from regulators around the globe. Recently, China – home to a significant portion of the world’s Bitcoin miners – has taken measures to crack down on cryptocurrency mining and trading. Their concerns revolve around energy consumption and financial stability.

The United States and other countries have also expressed concerns about the environmental impact of Bitcoin mining.But it’s not just regulatory pressures that Bitcoin miners have to worry about. Rising energy costs are also a significant challenge. As Bitcoin mining requires a substantial amount of energy, it becomes less profitable for miners to continue their operations as energy prices rise. Some miners have even been forced to relocate to areas with lower energy costs, such as Iceland and Kazakhstan.

Threil’s Beliefs of Bitcoin Mining

Thiel’s warning comes as Bitcoin continues to face significant volatility in the market. The cryptocurrency has experienced significant price fluctuations in recent months, with prices reaching an all-time high of over $64,000 in April before dropping to around $30,000 in May. While Bitcoin has since recovered some of its losses, it remains far below its April peak.

Although Bitcoin miners face numerous challenges, Thiel maintains a positive outlook on the cryptocurrency’s future. He predicts that the mining industry’s consolidation will result in a more stable and lucrative market. “We can expect more consolidation in the mining industry,” Thiel remarked. “The miners who can endure the difficulties will emerge even stronger.”

Thiel further said, “The larger miners that have the most çağıl fleets, the best energy costs and the most efficient are going to thrive while the smaller miners that either can’t raise capital, can’t upgrade their machines and can’t get out of essentially more expensive energy contracts are either going to consolidate or essentially going away,”

The Mining Industry

As the world of cryptocurrency mining continues to expand, competition has become fiercer than ever. According to recent reports, the global cryptocurrency mining market was valued at USD 1.92 billion in 2022, and is projected to reach a staggering USD 7 billion by 2032. This represents a compound annual growth rate of 12.90% from 2023 to 2032.

However, the process of creating Bitcoin to trade or spend comes at a steep cost. It consumes around 91 terawatt-hours of electricity each year, which is more than what’s used by Finland, a country with a population of around 5.5 million people. While the potential profits of cryptocurrency mining are undoubtedly enticing, it’s important to consider the environmental impact of this energy-intensive process.

End Note

Investors and industry insiders are likely to be closely following Thiel’s comments, as Bitcoin continues to encounter significant challenges in the market. While the cryptocurrency has a history of being highly volatile, many investors remain optimistic about its long-term potential. As the market continues to evolve, it remains to be seen how Bitcoin will fare in the coming years.